All About Guided Wealth Management

Table of ContentsThe Main Principles Of Guided Wealth Management The Definitive Guide for Guided Wealth ManagementThe 5-Second Trick For Guided Wealth ManagementTop Guidelines Of Guided Wealth ManagementThe Basic Principles Of Guided Wealth Management

For investments, make payments payable to the product supplier (not your advisor). Providing a monetary adviser total accessibility to your account boosts threat.If you're paying a continuous suggestions cost, your adviser ought to evaluate your monetary circumstance and meet with you a minimum of yearly. At this conference, make sure you review: any type of adjustments to your goals, scenario or funds (including adjustments to your income, expenses or assets) whether the degree of threat you're comfy with has actually changed whether your existing individual insurance coverage cover is ideal exactly how you're tracking against your goals whether any type of changes to laws or economic items could impact you whether you have actually obtained everything they assured in your agreement with them whether you need any type of changes to your plan Yearly an adviser must seek your composed authorization to bill you recurring recommendations charges.

This might occur during the meeting or online. When you get in or renew the ongoing charge arrangement with your adviser, they should describe exactly how to finish your relationship with them. If you're relocating to a new adviser, you'll need to prepare to move your monetary records to them. If you need aid, ask your adviser to discuss the process.

See This Report about Guided Wealth Management

As a business owner or small company owner, you have a lot taking place. There are several obligations and expenses in running an organization and you absolutely don't require another unnecessary costs to pay. You need to thoroughly take into consideration the roi of any services you get to ensure they are beneficial to you and your business.

If you are just one of them, you may be taking a huge threat for the future of your company and on your own. You may wish to keep reading for a listing of reasons that employing a financial expert is advantageous to you and your business. Running an organization has plenty of obstacles.

Cash mismanagement, cash money circulation troubles, overdue payments, tax obligation issues and other economic problems can be essential adequate to close a company down. There are numerous means that a certified monetary consultant can be your partner in aiding your organization thrive.

They can deal with you in assessing your financial scenario often to stop significant blunders and to swiftly fix any bad money choices. Many local business owners put on numerous hats. It's reasonable that you intend to conserve money by doing some work on your own, yet taking care of finances takes expertise and training.

Some Known Factual Statements About Guided Wealth Management

You require it to know where you're going, just how you're getting there, and what to do if there are bumps in the road. A good financial advisor can place with each other an extensive strategy to help you run your service much more effectively and prepare for abnormalities that arise.

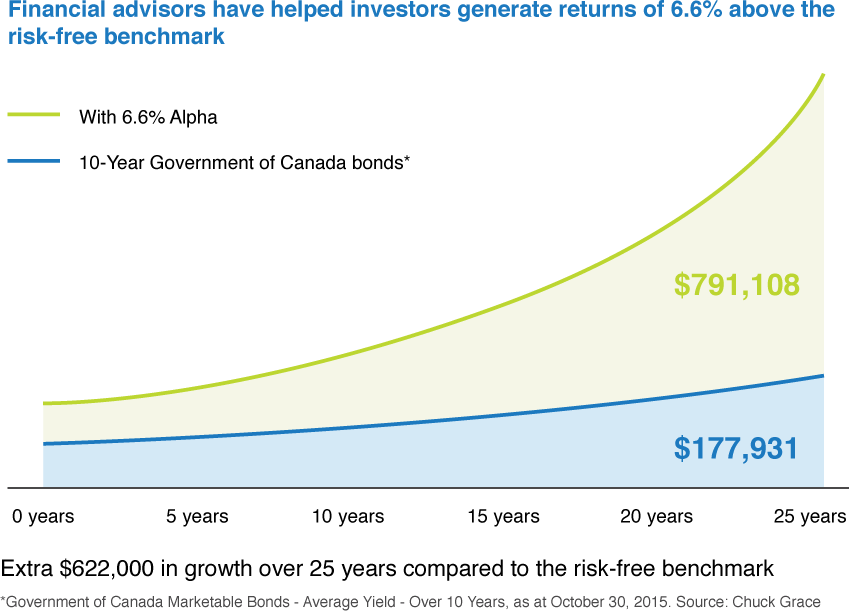

A respectable and educated monetary expert can guide you on the financial investments that are appropriate for your organization. Money Cost savings Although you'll be paying a financial advisor, the long-term financial savings will certainly warrant the price.

Minimized Anxiety over here As a service owner, you have great deals of things to stress about. An excellent financial expert can bring you peace of mind recognizing that your finances are obtaining the interest they require and your money is being invested intelligently.

Guided Wealth Management Can Be Fun For Everyone

Security and Development A competent financial consultant can provide you quality and help you concentrate on taking your service in the right direction. They have the tools and resources to utilize methods that will guarantee your organization expands and thrives. They can help you analyze your goals and identify the most effective path to reach them.

Getting My Guided Wealth Management To Work

At Nolan Audit Center, we give expertise in all facets of financial planning for tiny services. As a small company ourselves, we understand the challenges you encounter every day. Give us a phone call today to review how we can aid your company grow and succeed.

Independent ownership of the technique Independent control of the AFSL; and Independent reimbursement, from the customer just, through a fixed buck cost. (http://www.askmap.net/location/7116058/australia/guided-wealth-management)

There are countless benefits of a financial organizer, no matter of your situation. The goal of this blog is to confirm why everybody can benefit from an economic plan. super advice brisbane.